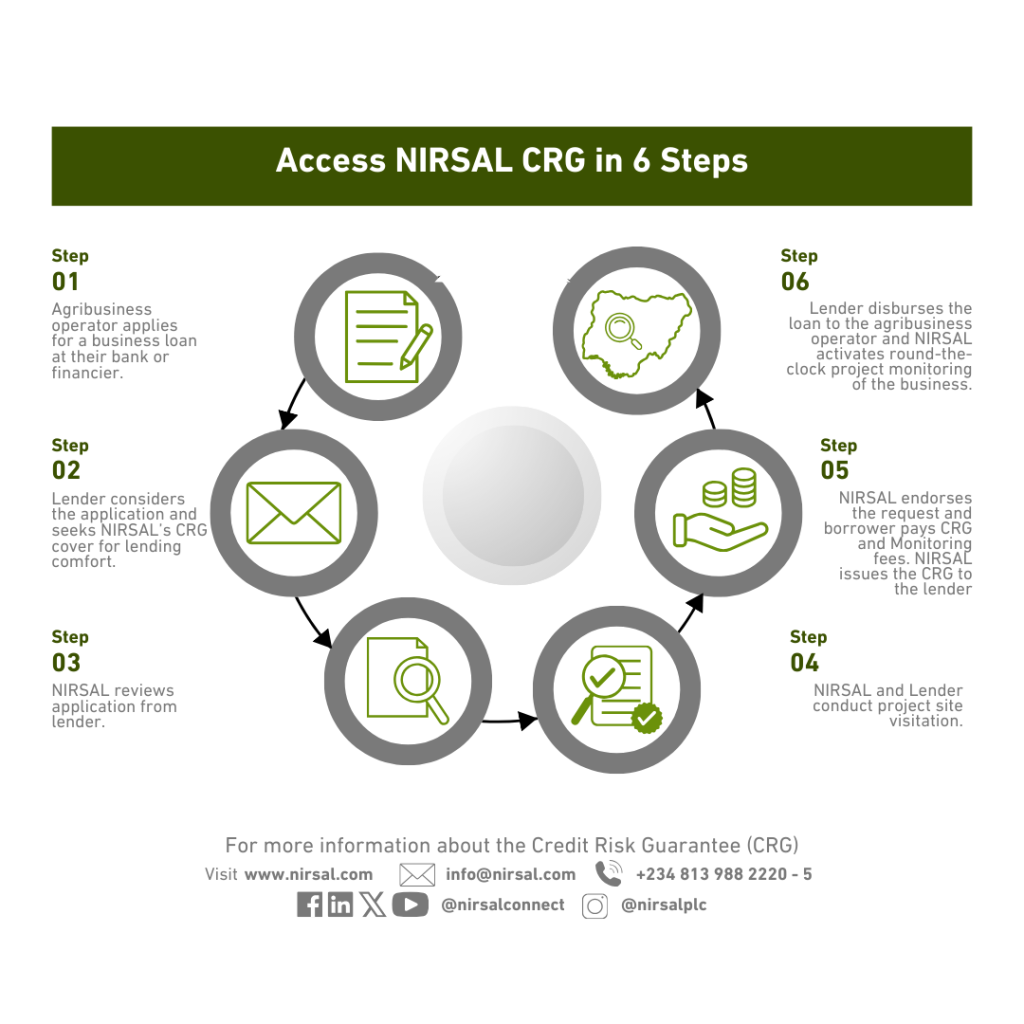

The NIRSAL Credit Risk Guarantee (CRG) is a mechanism for de-risking agriculture and agribusiness financing in Nigeria. It is an instrument issued to protect financiers and investors from possible losses in finance/credit transactions. With the CRG, NIRSAL indemnifies lenders to or investors in agribusinesses of the principal and accrued Interest of loans given to the limit of a pre-agreed CRG rate.

The NIRSAL CRG and all its components is an incentive for financiers/investors to participate more comfortably and profitably in the agriculture sector, providing loans and other debt instruments to agricultural value chain actors.

Leveraging the NIRSAL CRG, Deposit Money Banks and other financiers have securely lent over ₦211 billion to producers of crops and livestock, processors, distributors, and providers of logistics services across agricultural value chains, with a loan crystallization rate of 1% in 10 years.

Operators of agribusinesses and their bankers can jointly explore the benefits of the NIRSAL CRG for increased access to finance, round-the-clock project monitoring, and the chance to receive up to 40% in interest rebates.